Deriv multipliers are a type of leveraged trading product that doesnt have downside risk that is larger than the stake. This means one cannot use more than they invested. This is what makes Deriv multipliers one of the most popular products on the broker’s platform. We explain how it works and how to use it.

Deriv Multipliers Explained

Multipliers at Deriv is another way to refer toi leveraged trading. However, with Deriv Multipliers, there are certain differences – most notable one is that with Deriv Multipliers a trader cannot lose more than they have staked. This is referred as an automatic stop-out. Other than this, there are other benefits to trading Deriv Multipliers which we explain in the article.

Leverage is using borrowed money to expand a trader’s position beyond what would be possible with just their cash balance. Brokerage accounts provide leverage via margin trading, in which the broker delivers the borrowed money.

Leverage is often referred to as a “double-edged sword,” which means that while leverage can be beneficial to traders, it carries a massive inherent risk of monetary loss. However, with Deriv Multipliers, this is not the case.

Like with leveraged trading, multipliers enable you to magnify your potential gains. To increase your profits, you add a multiplier to your transactions. However, in contrast to leveraged trading, your potential losses will not increase.

Working with multipliers is straightforward. Depending on your market forecast, you have the choice between two options: Up or Down.

- If you choose “Up,” you can profit by closing your trade when the market price exceeds your entry point.

- If you choose “Down,” you can profit by closing your bet when the market price falls below your entry point.

Multipliers enable you to boost your profit margin by multiplying your original bet by a multiplier value. For example, suppose the market price fluctuates in accordance with your contract. In that case, your profit will be multiplied by your chosen multiplier.

Your profit will equal the percentage change in the market price multiplied by your bet plus a multiplier of your choosing. Deriv will charge you a small commission when you open a position with multipliers.

Furthermore, you can use Deriv Multipliers on your MetaTrader 5 trading platform while trading the following financial instruments:

- Forex

- Cryptocurrencies

- Synthetic Indices like

- jump indices

- volatility indices (Volatility 75 etc)

Step-by-Step on Trading Multipliers using DTrader

You can easily start trading on Deriv’s DTrader using Multipliers using these steps:

- Log into your verified Deriv Account. Alternatively, if you do not have an account, you can follow Deriv’s simple account registration to get started.

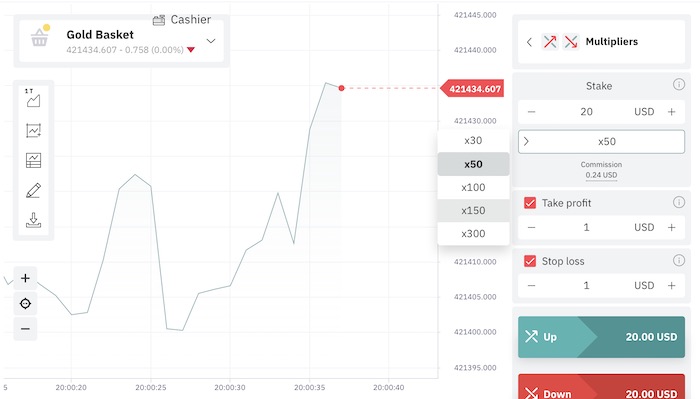

- Define your trade on the DTrader platform by selecting a financial instrument to trade, selecting “Multipliers” from the trading menu, and entering your stake amount. Next, you can choose the multiplier value with which you are comfortable. Furthermore, remember that this amount is by which your potential profit will be multiplied.

- Set your parameters. This optional step allows you to easily manage your risk by using Stop-Loss (SL), Take-Profit (TP), and deal cancellation orders. These orders automatically protect your trades by closing them when they are activated.

- Enter a position by choosing “Up” or “Down.” Remember that your trade will remain open until you close it manually or until your SL, TP, or deal cancellation orders are activated.

Deriv Multipliers Risk Management

Using multipliers in trading can boost your earnings potential without causing you to risk more than your initial stake.

Furthermore, you can limit your losses in volatile markets using Deriv’s innovative risk management tools.

Stop-Loss Order

If the market swings against your position, you can specify the maximum loss you are ready to accept using this function. When the threshold is met, the contract will terminate without further action from you.

Take-Profit Order

With this function, you can determine the maximum profit you are willing to take while the market is in your favour. When the market reaches this point, your trade will be immediately closed, and the proceeds will be sent to your Deriv account.

Deal Cancellation

If you want to cancel your position before it expires, you can get your initial investment back if you use deal cancellation at a certain time according to the market and asset you are trading. However, Deriv charges a commission for this service.

Automatic Stop-Out

Your maximum loss in a multiplier transaction on Deriv always equals your initial investment. Therefore, your positions will shut automatically when your losses reach a certain threshold.

Pros and Cons of Deriv Multipliers

Pros

- You can customize contracts according to your unique trading style and risk appetite.

- You can easily gain more exposure to financial markets while you limit the risk to your stake amount.

- Traders of any experience level can use Deriv Multipliers.

- Trading using multipliers can increase your confidence and flexibility in extremely turbulent markets.

- The deal cancellation mechanism guarantees that if the market price hits the stop-out level after a rapid price shift, the contract is promptly terminated, and the entire stake is refunded.

Cons

- If you forget to set your Stop-Loss, Deriv will close your position if the market moves against you.

- Certain risk management features cannot be used simultaneously. For example, you cannot use Stop-Loss simultaneously if you have Deal Cancellation active.

- You must conduct careful market analysis and have a decent working knowledge of trading fundamentals.

- There are no guarantees that you will profit when you use multipliers, even when you are an experienced trader.

- When you trade Crash and Boom indices, you cannot use deal cancellation when you use Deriv’s multipliers.

- Cancel, and close features cannot be used simultaneously.

FAQ

What are Deriv Multipliers?

Deriv multipliers combine the benefits of leveraged trading with the limited risk inherent in options trading. When the market moves in your favour, you can multiply your profits. Furthermore, if the market moves against you, your loss does not go beyond your initial stake.

Can I use Deriv multipliers on MT5?

You can use Deriv’s multipliers across different accounts on MetaTrader 5 when you trade forex, synthetic indices, and cryptocurrencies.

Can I lose more than my initial investment with Deriv Multipliers?

You cannot lose more than your initial investment because the multiplier has a default stop-out feature. Therefore, you will never lose more than you stake.

Can I quit my Deriv Multiplier position before its expiry?

You can quit your position up to 1 hour after you set the order through deal cancellation. However, a small fee is charged when this happens.

How high are multipliers for each asset type on Deriv in South Africa?

The multipliers on forex go up to x1000, while those on cryptocurrencies and indices go up to x100. This is on par with the leverage you can apply on conventional CFD trading.