Trading 212 is a licensed forex and CFD broker with offices in London that gives South African investors the ability to trade over 1,800 CFDs in forex, cryptocurrencies, stocks, commodities and indices.

Trading 212 is regulated by the Financial Conduct Authority (FCA) in the UK, under the license number 609146 and recently made news as being the first retail trading broker to bring free stock trading to Europe.

Now, while this is big news, what does it mean for South African traders? Is Trading 212 only good for European traders or can South Africans get in on all the craze?

We are here to tell you that Trading 212 is one of the best brokers for South African traders we have encountered in a while, so keep reading to find out all you need to know about Trading 212 South Africa below.

Trading 212 Review South Africa

The minimum deposit to begin trading with Trading 212 is only €100. This is considerably lower than most brokers that require €250 as the minimum deposit.

One of the immediate benefits we noticed when reviewing Trading 212 is that the company is entirely transparent when it comes to their trading conditions. Many scam companies hide this basic information, which is an immediate sign that you are dealing with an unprofessional broker.

Trading 212 proves to be professional and transparent, giving details lists of their specific trading conditions on each underlying asset (you can find a long list on their website).

We gathered all the basic trading conditions for South African traders below.

- Maximum leverage: 1:200

- Minimum trading lot: 0.01 lot

- Fixed spreads 1.9 pips / Variable spreads: 0.9 pips

- Minimum deposit to open an account: €29

- Minimum withdrawal amount: €29

- Working time: Monday – Friday, 10:00 pm – 9:00 pm (next day) GMT

Tip: If you completely new to trading and not sure what these terms mean, check out our forex trading for beginners guide.

Trading 212 Demo Account

Trading 212 offers all South African traders a free demo mode to practice trading and test out their platform entirely risk-free. The Trading 212 demo mode allows you to trade with virtual funds, which is especially important for beginners. Even more experienced traders like to make use of demo accounts, for it allows them to test out the broker’s platform before investing any real money.

It’s important to note here that this is not a separate account, like you might be used to from other brokers, but a mode within your Trading 212 account. Trading 212 allows South African traders to easily switch between Real Money Mode and Demo Mode, which the broker refers to as “Practice Mode” at any time.

This is even easier and hassle-free for South African traders, who may get confused by going back and forth between two accounts. Trading 212 has merged the experience.

Tip: Consider IQ Option instead – the best regulated broker for South African traders with a minimum deposit of only $10!

Trading 212 Platform & Assets in South Africa

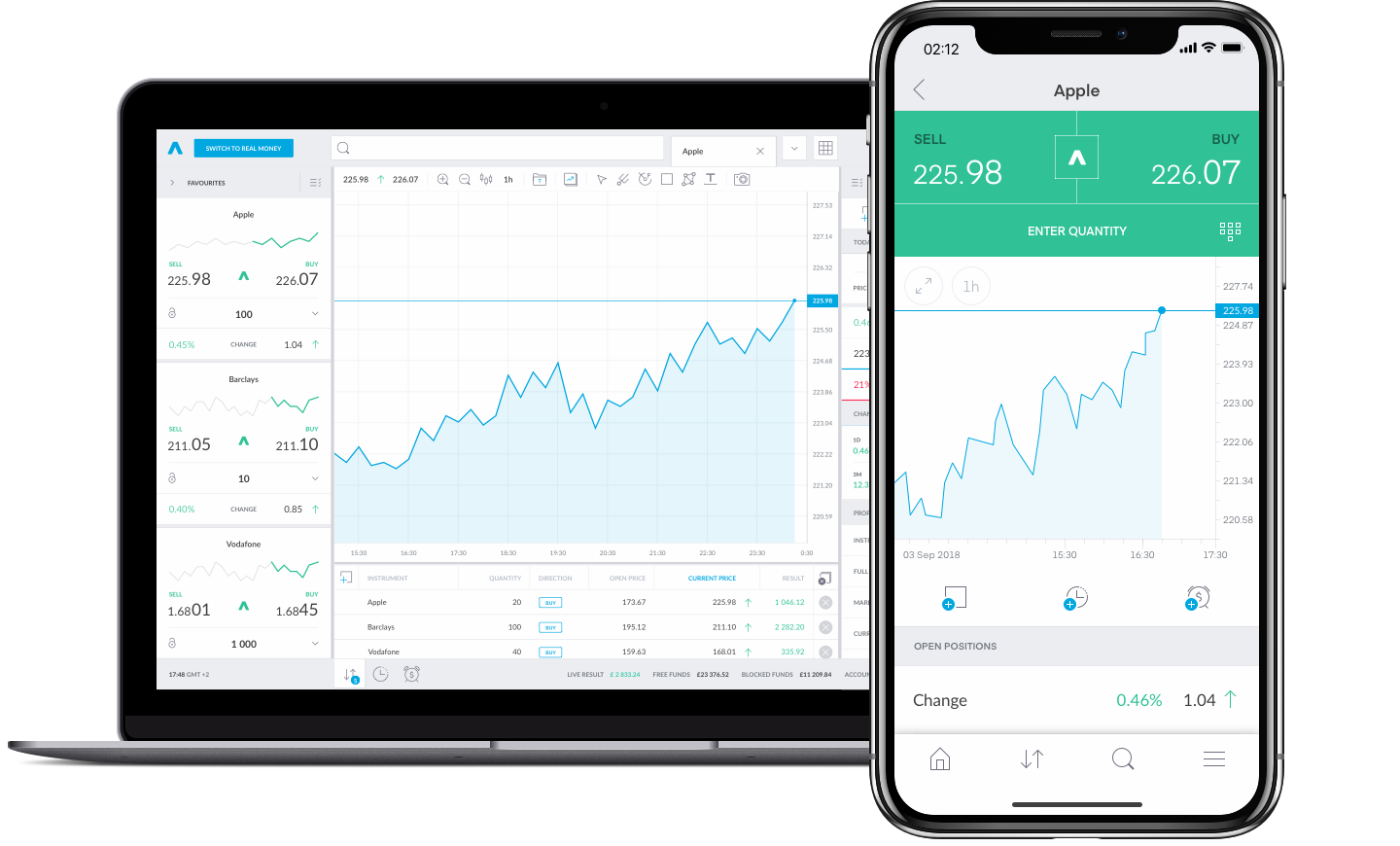

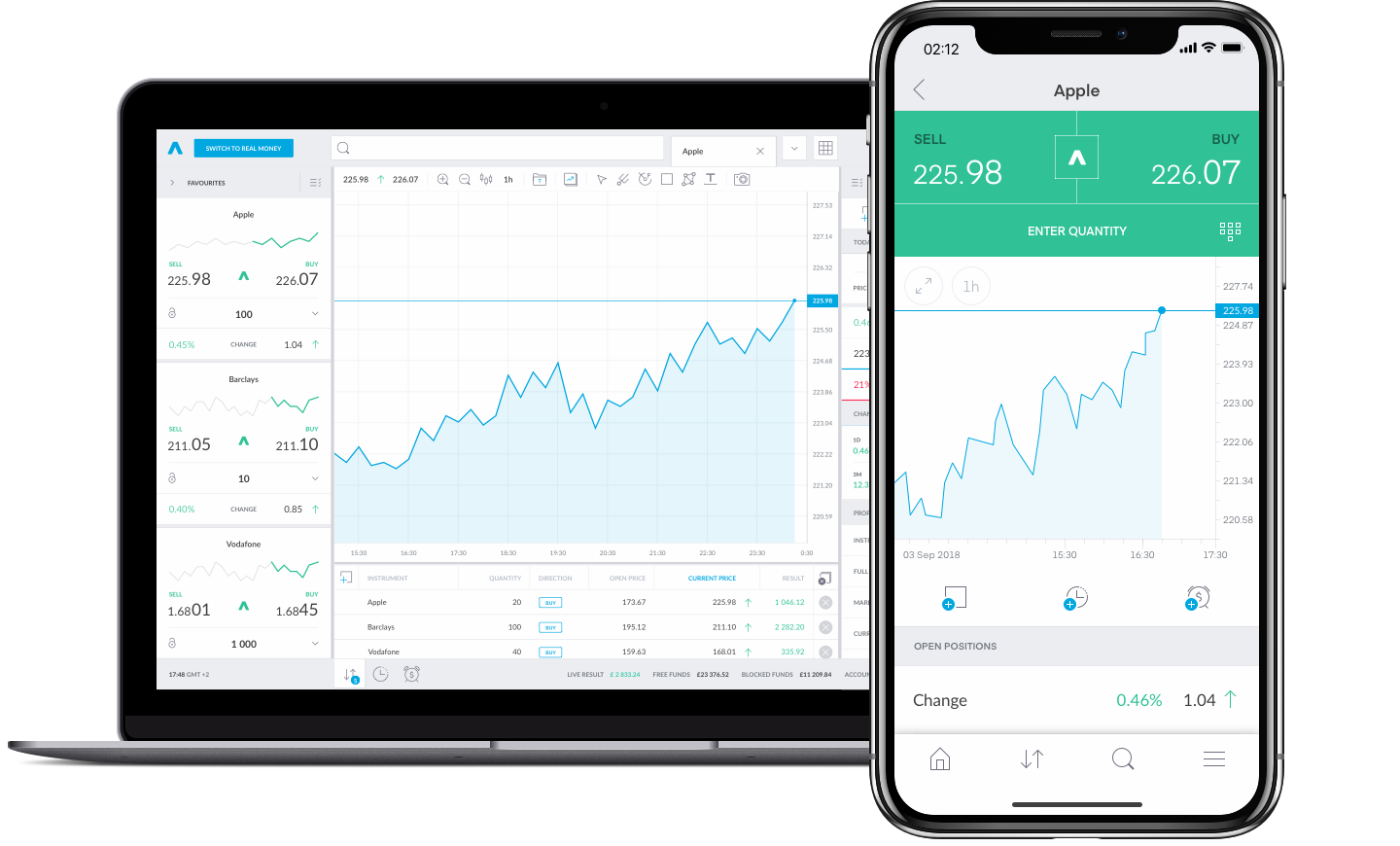

Trading 212 has created their very own unique trading platform, which is available as a web trader and a mobile app for South African investors who prefer trading on-the-go.

It’s important to note here that the Trading 212 app is one of the most popular trading apps worldwide, with over 14 million downloads. We even found it to be ranked #1 in the UK and Germany, which is especially impressive.

When testing the app ourselves, we noticed that it is especially user-friendly with a simple, yet powerful interface and a variety of features. We would recommend it to both beginners and experts.

As you can imagine, the Trading 212 app is indeed of top quality, so we would of course advise you to choose and download the app when trading with this broker. The Trading 212 app is available on both Google Play and the App Store.

Trading 212 does not have the other famous trading platform, MetaTrader 4 available – which would usually be a disappointment, but when it comes to the quality of their personal brand, why even need MT4?

The assets available to trade are ETFs and CFDs on all major financial markets, which include forex, stocks, crypto, indices and commodities. If you want an official list of all the assets specifically, you can visit their official website. For now, South African traders will not have access to commission-free trading but in the future who knows? Trading 212 is showing very promising features.

Learn to Trade for Free on Trading 212

Another feature that impresses us with this broker is that Trading 212 takes the education of their traders seriously and offers a wide variety of informative material for South African trader to enjoy for free. This not only includes videos, guides, tutorials and an extensive trading glossary, but an official Trading 212 YouTube channel with hundreds of educational videos and new content uploaded every week.

All trading entails risk and it is essential to understand all the basic terms and processes before investing any real money. Trading 212 even offers a tutorial of their infamous platform and a demo mode to practice – as explained above.

It’s safe to say we were impressed by all this broker strives to offer.

Trading 212 Customer Support in South Africa

South African users can reach the Trading 212 customer support team via the email [email protected] or the online contact form on their website. We tested out both options and found that the response was quick and professional.

The broker does not offer a live chat option or a South African phone number, so we would advise South African traders to use the methods given above. You can also check out their extensive FAQ section that answers all the basic questions.

Trading 212 Company Info & Payment Methods

Trading 212 is owned by the company Trading 212 Ltd, which is based in London, UK. Specifically, the company is located at 107 Cheapside, London, EC2V 6DN.

The forex and CFD broker accepts a wide variety of payment methods, all of which are listed below.

- Credit/Debit Card (Visa, MasterCard, Maestro)

- Bank transfers

- Skrill

- Giropay

- Carte Bleue

- Direct eBanking

- UnionPay

- Dotpay

- SafetyPay

- Mister Cash

- CashU

Trading 212 Scam

Through our careful review of this broker, we can honestly say Trading 212 is not a scam – in fact, they are far from it. Trading 212 was found to be an excellent, professional broker which we recommend to all South African traders hands-down.

We don’t give recommendations lightly, so we would advise you to check out this broker soon. If you want to trade with one of the best brokers in the market right now, go with Trading 212. You won’t regret it.

Don’t take our word for it? Check out our reasons below.

- Licensed and regulated by the FCA

- Trading app ranked #1

- Transparent and professional company

- First broker to offer free stock trading in Europe

- Demo mode + all the education material you need available

- Low minimum deposit of only €100