What is Deriv?

Deriv is a relatively new forex and CFD broker that was established in 2020 by the same team who ran Binary.com. Whoever traded in the last decade will have heard of Binary.com. They were a European trading powerhouse, licensed in Malta, but present all over the world. Deriv is their next adventure. Existing Binary.com traders are being moved to Deriv as part of the rebranding. The license in Malta, for EU countries, remains, but several more global licenses have been added, most notably from British Virgin Islands and Vanuatu. Deriv doesn’t have a FSP license in the South Africa, however it is offering regulated online trading through its other licenses. Deriv headquarters is located in the EU, specifically in the island country of Malta.

Compare Binary.com vs Deriv.

Deriv Real Account Registration South Africa

South African traders will have an easy way to open an account with Deriv.com. One can use the standard data inout, such as the email and desired password, but Deriv also offers Facebook, Google and Apple ID as a quick way to open an account. Note that neither of these will share your personal information with Deriv, other than the email and password. You will have to enter them at a later stage.

We chose Apple ID to sign up with Deriv. We like this option because Apple will create a random address instead of sharing your personal email with the third party, while you still get all the emails forwarded to you. The process of opening an account with Deriv is easy:

- Click the button for Apple / Google / Facebook login, or enter your email

- Approve the login with the service, or enter the password if you chose manual signup

- You are in!

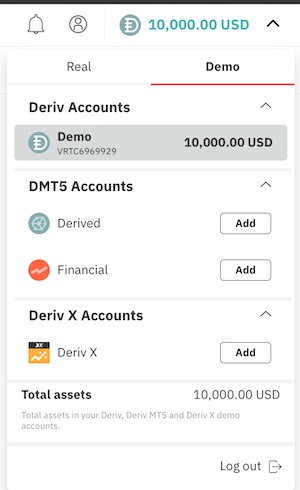

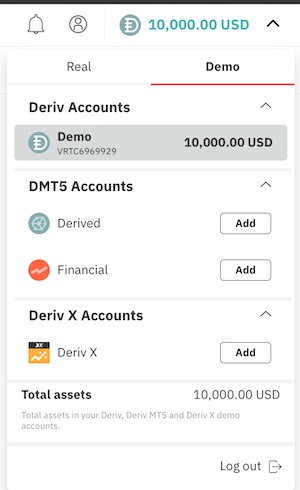

Deriv will open the Deriv Demo account for you, with 10000 on the Dtrader. From there you can open all kinds of real Deriv accounts, including those with MT5.

Open Deriv Real Account MT5

It is very easy to create an account with Deriv. However, you are not done. Next step is opening more accounts. At first, we were a bit surprised but it is expected. If you ever used a CFD broker, you already expect that MT5 will have a separate account and login, same with MT4. It works similarly with Deriv. For each platform type you need to open a new account.

It is very easy to create an account with Deriv. However, you are not done. Next step is opening more accounts. At first, we were a bit surprised but it is expected. If you ever used a CFD broker, you already expect that MT5 will have a separate account and login, same with MT4. It works similarly with Deriv. For each platform type you need to open a new account.

- Select DMT5 from the drop down in the upper right corner

- Create your MT5 login

- Download MT5

- Enter the login data

- Trade

Deriv.com offers trading of various financial products, including forex options, CFD spreads, and binary options. Flexibility and user-experience of the platform are enhanced due to the integration of the MT5 trading platform. It is no secret that MT5 allows individual traders to configure the platform as per specific trading preferences. Users can access multiple trading windows, and set up trading charts and areas according to flexible parameters like MT5 Volatility indices.

Along with the latest MT5 trading platform, Deriv also offers a web-based trading platform named DTrader, an automated trading system called DBot, and an in-house tool SmartTrader to enhance the user experience. More about these below in text.

Downside to this is the fact that you need to manage all these accounts. Again, business as usual with Metatrader, but we at least expected that Deriv proprietary services will all run on the same native account we created from the start, so we were a bit disappointed when we suddenly had to open all these accounts for the review.

We will make it easier for you.

We doubt all traders will want to use all the platforms. If you are an MT5 aficionado, you will probably not even bother to use Dtrader or DerivX.

We recommend first deciding which kind of platform and which type of assets you want to use, and then open accounts. Trust us, it will save quite some time. For this read further.

Deriv Accounts Review – Demo, Derived, Financial

Deriv Demo Account – get $10000 virtual funds to test the platform

Deriv Dtrade demo account will be the first thing you see when you open a Deriv account. With initial $10000 virtual play money you can try trading without worries, but obviously without any returns in real currency. To try other platforms for Demo, you guessed it – you need to open separate accounts. Good thing is that you can always top up the demo with extra virtual $10000.

Overall Deriv Demo accounts offer complete copy of the real trading platform but without the risk for your own money. This is the account you use to choose which platform to use.

Demo account is also your only option to trade risk free, since Deriv does not have any promotions or bonuses.

Deriv Derived Account

With Derived accounts the goal is to let traders use Deriv synthetic indices as the base asset of your trades. These synthetic indices are quite a hit and sought after by traders. They are generated by an RNG (random number generator) which makes them much more challenging to trade. However, their volatile nature is what traders love.

To open any Deriv Derived account,

1. just open the drop-down menu in the top right corner of the screen,

2. decide if you will use it in Demo or as a Real account and

3. click on the button to open the account.

4. Select a license (we chose BVI because it’s financial services license which means better protection)

5. That is it!

With the Derived account you get

- 1:1000 leverage

- Margin call at 100%

- Stop out level at 50%

- Trading with Crash300 and Boom300 index,

- Trading Volatility200 and Volatility300 index

- 20+ available both on MT5 (CFDs) or with Multiplier instrument in Dtrader

Deriv Financial Account

For those who prefer to trade based on prices of real assets, Deriv Financial account is the choice. Use Financial account to trade stock, commodities, forex, or indices. Advantage of Deriv Financial account is that it offers more assets than the Derived account – 90 vs 20.

Process to open the account is same as with the derived account.

- Leverage: 1:1000 (1:100 if Labuan* chosen as License)

- Margin call at 100%

- Stop put level at 50%

*Please note that with Labuan license you can only trade forex and cryptocurrencies. This will be important to know for crypto traders. While it is a bit limiting factor, 1:100 leverage for crypto is much higher than the industry standard.

Deriv Trading Experience – Many modes of trading using Deriv trading platforms

Deriv offers several platforms and trading modes for South African traders that are not available in EU and in some other parts of the world:

- Deriv MT5: Full MetaTrader 5 terminal for trading just about anything

- DerivX: Deriv’s multiasset CFD platform

- Dtrader: Derivs Web Trader with access to synthetic indices

- Deriv Go: Mobile app

- Smart Trader: another type of Deriv web trader platform

- Dbot: CFD robot trading system where you set the rules

- Binary Bot: binary options trading bot

One of the exciting features of trading with Deriv.com is the availability and flexibility of using a range of trading platforms, to suit individual preferences and needs. These platforms are briefly discussed below.

DTrader is a web-based trading platform that allows trading in over 50 financial assets, including digital, multiples, and lookback options of forex, commodities, synthetic indices, and stock indices. This advanced trading platform offers three different types of contracts, which are Digits, Ups/ Downs, and Highs/ Lows.

DBot (Deriv robot) is a web-based automatic trading system that allows trading in digital options. Traders can program the trading bot according to their individual preferences. Under the block menu, traders have the option to choose desired blocks for trading. A detailed guide related to trading with DBot is available on the company’s website.

SmartTrader platform is built in-house by Deriv.com and is preferable because of its reliable user experience and ease of conducting the trading business.

Last but definitely not the least, DMT5 (based upon MetaTrader 5) is one of the most trading platforms in recent years. MT5 is a third-party trading platform that allows trading in a wide range of financial assets across various mainstream financial markets. With advanced trading tools and professional data set, DMT5 may be the most desirable platform for seasoned traders. MT5 also enables the use of Deriv signals, which can be obtained from various signal providers in the MQL community.

Overall, it depends entirely upon the traders to choose one of the above-mentioned trading platforms, to suit their specific needs and trading requirements. depending on the strategies you use while trading, you will have to think about the platform to trade on. For Boom and Crash strategy, for instance, it might be best to use DMT5 platform. For simpler things, Dtrader will be enough.

In our experience, if you know what you are doing, you cannot go wrong with MT5 platform. It is the golden standard and the knowledge is transferable to any other serious broker out there.

Assets That can be Traded via Deriv

Find out more about of Deriv spreads, fees and commissions.

Is Deriv Regulated in South Africa

The answer to whether Deriv Broker is regulated in South Africa is no. It will not affect your ability to trade there or receive your winnings and profit either. Deriv.Com holds an operational license for over 100 jurisdictions inside and outside the EU. However, some of its services may not be available in few popular jurisdictions, such as Malaysia, France, UAE, USA, Canada, Hong Kong, and Israel at present. It is because of the fact that Deriv’s registration with few regulatory agencies, such as the Financial Conduct Authority (FCA) UK, the Australian Securities and Investments Commission, and lastly with MFSA and MGA on Malta. To conclude, Deriv is legit in south Africa and people can use this broker to trade from the country.

Deriv Pros and Cons

Deriv Pros

- offers CFDs, Options, Multipliers, Binary options

- only cca. 90 ZAR minimum deposit (5 EUR/USD)

- MT5, web trader and automatic trading with signals

- low spreads

- Deriv Demo account is limitless

- mobile trading app

- South African support (in English)

Deriv Cons

- single login credentials for all accounts would be less confusing

- more asset types would be better for advanced traders

Deriv Login

The registration process is comparatively easier, and a user can register with just an email ID to access a demo account without any sort of hidden fees or minimum deposit requirement. Once users start real trading with real money, they get to access all the markets and platforms as well as all the desired technical support and analytical tools.

As per prevalent rules and regulations by all the major financial regulatory bodies, the minimum age for trading at Deriv remains to be 18 years. Building upon Binary.com’s strict privacy and security parameters, Deriv is likely to be a highly secure trading platform.

Deriv Payments

In order for an online trading broker to be trader-friendly, it needs to be flexible with the payment methods for both deposit and withdrawal. Deriv.com definitely ticks this box, as a range of payment options are available. It is important to mention here that the minimum and maximum limits for both withdrawal and deposit may largely depend on a particular payment method chosen by traders. It is, therefore, important for traders at Deriv.com to carefully analyze various available options, and choose one according to their specific needs. Just to give an example, there is no minimum limit for deposits via cryptocurrencies, while the minimum limit for bank wire may be anywhere between $5 and $500 depending upon a particular wire transfer method. Similarly, bank deposits may take up to 2 working days.

Talking about currencies, you may use either of USD, EUR, GBP, or AUD for bank wire. If you are using Help2Pay or Paytrust, only USD currency may be deposited. Debit/ Credit cards remain the most preferred mode of deposit and withdrawal due to several benefits these cards may have to offer. The deposits with these cards are reflected instantaneously in the Deriv account, while withdrawal usually takes one working day.

>>> We advise to use ZingPay to deposit since Capitec bank cards are being declined. <<<

For both sorts of transactions, the limit is set between $10 and $10,000. Remember when using a credit card to deposit money into your trader account, authorize the transaction beforehand by placing a request at your bank in order to avoid deposit request denial. E-wallets, such as Skrill and FasaPay are also popular for these payments.

Moreover, traders may also use any of the mainstream cryptocurrencies, such as Bitcoin, Litecoin, or Ethereum, to deposit or withdraw the money. While there is no minimum limit for depositing funds via digital currencies, the withdrawal limit varies and depends upon the ongoing exchange rate between the underlying digital currency and the United States Dollar.

Deriv.com has modern protocols in place to ensure secure financial transactions. Every time a trader places a withdrawal request, a verification link is mailed to the registered E-mail address, which needs to be verified within an hour for successful withdrawal. Find out more about Deriv verification.

Remember that a dormant fee is charged on each account that remains completely idle for twelve months, i.e. no buy or sell transaction for a continuous period of 12 months or more. So, if you decide to conduct your trades with Deriv.com, you need to be fairly active in your trading endeavor.

Deriv Minimum Deposit in ZAR

You cannot deposit directly in ZAR using Deriv, however, you can use some of many payment options they support – like ZingPay, which will do the conversion for you instantly. So basically you dont have to anything and the exchange rate used is the best on the market, without fees.

What is the minimum deposit on Deriv in South Africa?

The minimum deposit for credit cards is $10 and $5 for Skrill and Neteller.

Similar to Binary.com, the minimum deposit for real trading at Deriv.com is $10 only for Debit/ Credit Card payments, while $5 for E-wallets. Similarly, a minimum deposit for bank wire transfer may range from $5 to $500, depending upon the specific method. However, there is no minimum deposit for cryptocurrencies’ payment method.

Standard financial protocols are in place to segregate clients’ money from the firm’s own money and are kept in top financial institutions. This is crucial as it allows instant processing of money withdrawal requests by the clients.

You can find the Deriv deposit process explained, with some special instructions for Deriv Mpesa deposit.

Deriv.com South Africa Support

When trading on a brokerage platform with a track record of over two decades, you’d expect live chat as one of the most obvious support functions. Unfortunately, this isn’t available at Deriv.com. It’s a bit shocking since a majority of competitors in this market have a live chat option.

This button acts as the first response to visitors and novice traders’ questions. More importantly, it may improve the overall level of comfort for visitors, since they know they have someone to directly ask anything and everything about the platform. Deriv.com (previously binary.com) is a big name and the reason for the non-availability of the live chat option is uncertain. Apart from that, however, the platform has a very reasonable support system in place to help visitors and traders.

Under the “resource” tab, you’d find the “How can we help” page, which includes all the FAQs pertaining to Deriv.com and trading services offered by the platform. All the common questions, ranging from very basic information to highly technical stuff, are adequately answered here. Similarly, answers to various common questions are available in the “Account” page, which can be accessed from the “Help” page.

For more specific queries and questions related to the trading platform or the trading itself, clients have the option to get in touch with Deriv’s support staff via the official helpline, 24 hours from Mon – Fri, and from 08:00 to 17:00 GMT (+8) during the weekend. If you are not in a hurry to get your queries answered, you may write to the firm’s support staff at [email protected].

Deriv.com Conclusion

Online trading is the primary source of active income for millions of traders. An even greater number of traders use it for passive income. Overall, online trading of all the mainstream financial instruments and commodities is regarded as a reliable career choice.

The availability of a diverse range of products to trade, technical/ analytical tools, and user-friendly trading platforms provides a unique opportunity to get yourself tailor-made trading set up.

Forex is the biggest international market that runs 24/7. At Deriv.com, Forex is one of the dozens of financial assets that can be traded. As per the officially available data, Deriv.com has over 1.2 million trading accounts, and the financial value of the total trade from this platform has been just over seven billion dollars.

So, is Deriv.com a reliable online broker?

Based on the information provided above, definitely yes! And is it the best trading platform? We don’t know this, as it is up to each individual trader to decide who’s the best. However, the bottom line is that as per everything learned in this thorough review, it is safe to say that Deriv.com has all the essential ingredients to make it one of the most desirable trading platform for both newbies and professional traders.

Compare Deriv to Other Brokers

We have prepared thorough comparisons of Deriv vs other popular brokers so you can make a choice more easily for yourself. We compare everything Deriv offers with these competitors:

Deriv Review FAQ

When was Deriv established?

Deriv was established in 2020, however the biggest expansion happened in 2021 when they started moving Binary.com customers to the new brand.

Is Deriv legit in South Africa?

Deriv is legit in south Africa and can be used by South African traders with no fear. They have licences from across the world which guarantee they are under government oversight.

Where is Deriv located?

Deriv headquarters in in Malta, Europe. Malta is part of the EU which requires trading companies to adhere to highest standards in customer protection. They do have smaller offices around the world. No office in South Africa is open yet.

How does Deriv make money?

Deriv makes money through spreads. They do not charge trading fees, so the prices customers see are the final ones, while low spreads compared to market rates are Deriv’s source of income. They make money through every trade. The more trades are placed, the more income they take in. This means that Deriv doesn’t make money from customers’ losses which is important to avoid conflict of interest.

Is Deriv a good broker?

Our verdict is that Deriv is a good broker for general traders who want easy access to many markets with reasonably low spreads and no fees. What makes Deriv great for South African traders is a long list of trading instruments offered, as well as many payment methods available for South African traders.

It is very easy to create an account with Deriv. However, you are not done. Next step is opening more accounts. At first, we were a bit surprised but it is expected. If you ever used a CFD broker, you already expect that MT5 will have a separate account and login, same with MT4. It works similarly with Deriv. For each platform type you need to open a new account.

It is very easy to create an account with Deriv. However, you are not done. Next step is opening more accounts. At first, we were a bit surprised but it is expected. If you ever used a CFD broker, you already expect that MT5 will have a separate account and login, same with MT4. It works similarly with Deriv. For each platform type you need to open a new account.